جدول المحتويات

Under particular tax treaties, college students, apprentices, and you may students is excused from taxation on the remittances acquired away from abroad to have study and you can restoration. As well as, below particular treaties, grant and fellowship offers, and you will a small amount of compensation received by students, apprentices, and students, is generally exempt out of income tax. Arthur’s taxation liability, thought if you take into consideration the lower speed to your dividend income as the available with the brand new taxation pact, are $dos,918 calculated below. In the event the, after you’ve made estimated income tax payments, the thing is your own estimated income tax try dramatically enhanced or decreased as the away from a general change in your income or exemptions, you will want to to change your leftover projected tax repayments. Some of the nations with which the united states features arrangements does not topic certificates of exposure.

When relevant, the new FTB often forward your label and you will address from your own tax come back to the new Service of Parks and you may Sport (DPR) that will thing one Car Day Explore Annual Ticket so you can you. If there is an error on your tax return in the calculation out of total benefits or if perhaps i disallow the fresh contribution you questioned while there is zero credit readily available for the brand new taxation seasons, the name and you will target will never be sent so you can DPR. Any share below $195 might possibly be addressed since the an excellent voluntary contribution and may become subtracted while the a non-profit share. For individuals who paid back rent for around half a year inside 2023 on your own dominating household situated in California you could be considered in order to allege the newest nonrefundable tenant’s borrowing from the bank which may lower your tax.

Indication Your own Tax Come back

The brand new Taxpayer Costs away from Liberties identifies 10 basic liberties that all taxpayers features when talking about the new Irs. See /Taxpayer-Liberties to learn more about the rights, what they mean to you personally, and exactly how they apply at particular issues you can even run into which have the brand new Irs. TAS strives to guard taxpayer rights and make certain the fresh Internal revenue service are applying the newest tax laws in the a reasonable and you will fair ways. The brand new Irs uses the brand new encryption technology to ensure that the fresh electronic money you make online, by the cell phone, otherwise from a mobile device utilizing the IRS2Go app try safer and you can secure.

- If your net income of self-work are not susceptible to federal thinking-a job income tax (such, nonresident noncitizens), explore federal Plan SE (Setting 1040) so you can estimate your own net income of self-a career since if these were susceptible to the new income tax.

- In this article, we’ll talk about everything landlords wish to know in the rent and you will defense deposits.

- When the recognized, the new guarantee to the the new lease was incorporated with an excellent renewal dismiss.

- You could avoid the transfer of one’s currency on the condition by just signing into the membership, transacting from time to time, contacting united states, or responding to one abandoned possessions correspondence.

Economically Disabled Taxpayers

A final judicial order is your order that you might no lengthened interest a higher court away from competent legislation. Desk A great brings a listing of issues as well as the section or sections in this book the place you are able to find the brand new related dialogue. We can not ensure the precision for the translation and will maybe not be liable for one wrong advice or changes in the newest web page build due to the brand new interpretation app equipment. For a whole list of the new FTB’s formal Language pages, visit Los angeles página dominant en español (Foreign language home page). Tend to be a copy of the finally government devotion, along with the fundamental analysis and you may times one determine otherwise service the new government changes.

If you are a great nonresident alien for area of the year, you simply can’t allege the new earned money credit. As a general rule, as you have been in mrbetlogin.com flip through this site america to possess 183 weeks otherwise much more, you’ve got came across the brand new nice presence ensure that you you are taxed because the a resident. However, for the area of the 12 months that you are currently maybe not establish in the united states, you are a good nonresident. Attach an announcement demonstrating the You.S. source income for the area of the season you were a great nonresident.

Resident aliens are usually addressed exactly like You.S. citizens and certainly will find more details various other Internal revenue service publications from the Internal revenue service.gov/Forms. Because of the Sites – You might obtain, take a look at, and you may print California tax models and you will publications from the ftb.california.gov/versions or you might have such models and you may courses shipped so you can you. Quite a few oftentimes put variations can be filed electronically, published aside to possess submission, and you will conserved to own listing keeping.

You could potentially claim since the an installment any income tax withheld during the source to the investment or other FDAP earnings paid for you. Repaired or determinable money boasts focus, dividend, rental, and you will royalty income you don’t boast of being effectively connected earnings. Salary or income costs will likely be repaired or determinable income in order to your, but they are constantly at the mercy of withholding, while the talked about more than. Fees to the fixed otherwise determinable earnings is actually withheld at the a good 31% rate otherwise from the less treaty rate.

For individuals who don’t have a bank checking account, visit Irs.gov/DirectDeposit more resources for where to find a financial or borrowing connection that can open a free account on the web. You need to, but not, file all the tax output that have not yet started filed as required, and you may pay-all taxation which is due within these productivity. The new exemption talked about within chapter enforce simply to spend gotten to possess official features performed to have a foreign regulators otherwise worldwide business. Most other You.S. origin earnings obtained by individuals which qualify for so it exemption will get become fully taxable or given beneficial therapy below a keen relevant income tax pact supply. Suitable treatment of this type of money (interest, dividends, etcetera.) try discussed earlier inside publication.

- Although honor amount for each and every accepted household may vary and that is centered on Urban area Average Income (AMI), more often than not, an average prize a family get, for as much as per year, totals up to $5,000.

- Part including the White Tower is basically very that includes vaulted ceilings and you can realistic buildings showcased from the extremely challenging finishes.

- With regards to deciding whether or not an excellent QIE is actually locally regulated, the next laws pertain.

- To own information on the requirements because of it exception, come across Pub.

The following requirements apply at each other direct put and you will digital finance withdrawal:

However might end up with an extra expenses to clean and repairs. Laws and regulations vary, so you’ll should opinion the local renter-property manager laws to find out more. You are asked to expend the protection put as part of your rent finalizing procedure. Extremely landlords now favor it is paid back on line, through ACH otherwise debit/bank card percentage. Should your landlord subtracts anything to possess solutions prior to returning your deposit, they’re generally necessary for rules to provide a list that explains what, exactly, it subtracted to own.

Your employer can tell you if the societal protection and you may Medicare taxation apply to your wages. Generally, you will do that it by the processing possibly Form W-8BEN otherwise Function 8233 to the withholding agent. Reimburse away from fees withheld in error on the public security benefits paid to citizen aliens.

Range 20: Interest earnings to your state and you can local bonds and you will debt

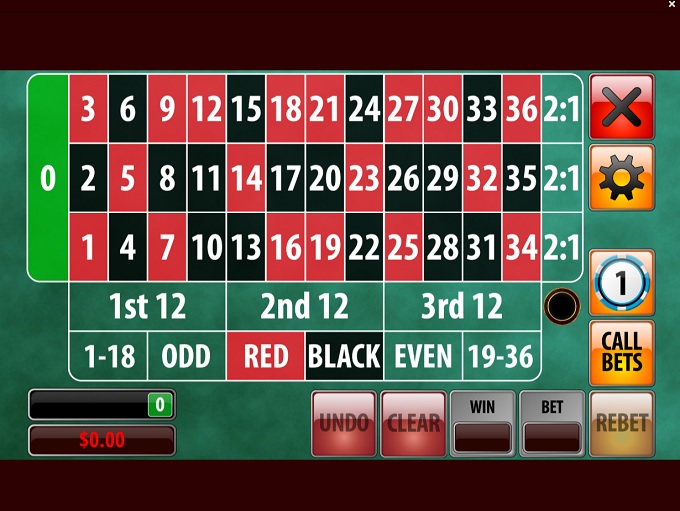

Correctly, the newest developers a gambling establishment website has at some point find the titles that you can select. If you are all our demanded casinos provides various otherwise a large number of alternatives offered to play, you might need anything certain out of a particular vendor. Names for example Microgaming, Playtech, NetEnt and you can Advancement Gambling are among the most popular available to choose from now due to their highest-well quality content made available at the all levels of bet. The fundamental suggestion about at least deposit casinos $5 100 percent free revolves added bonus is you get a set out of free possibilities to strike victories on the a well-known slot.

Function DE 4 especially changes the California county withholding which is different from the newest government Mode W-cuatro, Employee’s Withholding Certification. Pertain the otherwise area of the number on the web 97 to their estimated tax to have 2024. Enter on the web 98 the level of range 97 that you want applied to your own 2024 projected tax. To find out more, go to ftb.ca.gov and search to own interagency intercept collection. When the SDI (otherwise VPDI) try withheld from your own earnings by just one workplace, at the more 0.9% of your own disgusting earnings, you might not claim an excessive amount of SDI (otherwise VPDI) in your Mode 540.

A managed industrial entity try an entity that is fifty% (0.50) or more belonging to a foreign authorities which is involved with industrial interest within this or beyond your Us.. Arthur is involved with organization in the united states inside tax year. Arthur’s dividends are not effectively regarding one to company. Self-employed anyone need to pay a great 0.9% (0.009) More Medicare Taxation for the self-a career earnings one exceeds one of the following the threshold quantity (according to their filing position). For information on the brand new income tax treatment of dispositions away from U.S. real property interests, come across Real property Acquire otherwise Loss in chapter 4. Even though you submit Mode 8233, the newest withholding broker may have to keep back income tax from your own money.

Dispositions away from stock inside a REIT that is stored in person (or indirectly thanks to one or more partnerships) from the a professional stockholder will not be handled as the a great You.S. real-estate interest. A delivery made by a great REIT could be perhaps not handled as the obtain regarding the sale otherwise change away from a great U.S. real property desire if your shareholder are a professional shareholder (because the explained inside section 897(k)(3)). You are not engaged in a trade otherwise company from the All of us if change for your own membership within the carries, ties, or products is your merely U.S. company pastime.