جدول المحتويات

Content

Appropriately, you happen to be a citizen for sales taxation motives even if you may not become a resident to own taxation motives. Also add one to an element of the government amount you gotten while you was a citizen. People couch potato pastime losings should be recalculated as you recorded independent government output for the resident and you will nonresident periods. To calculate this matter, play with a duplicate of government Agenda D (Setting 1040) since the a worksheet, plus the federal conditions to have figuring financing growth and you will losings merely for transactions that have been away from Nyc supply. If you have an internet funding loss for brand new York County motives losing is limited so you can $step three,one hundred thousand ($1,five hundred when you are hitched and you may submitting individually) on the Nyc Condition go back. You need to lose one harmony away from a loss of more than the amount said on your own 2024 get back because the a carryover loss to the productivity for retirement.

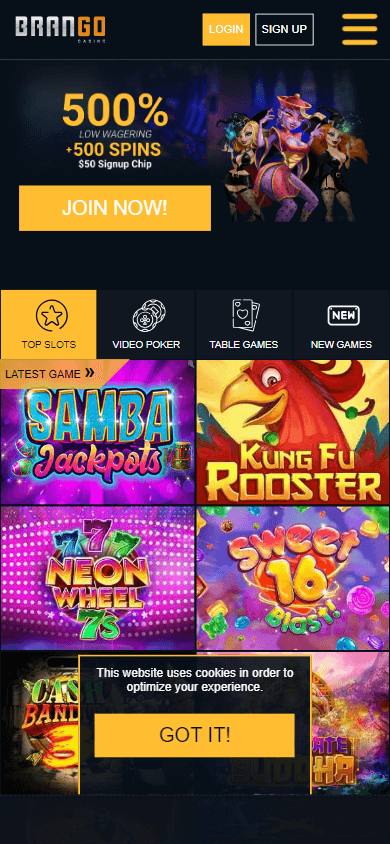

You can start to play today that have a tiny deposit because the reduced while the 5 cash. The very detailed gambling enterprise analysis and you may proprietary rating program are made making it so easy to pick out and therefore solution from some highly rated gambling establishment websites tend to fit the greatest. As well, picking right on up special added bonus now offers to have small minimal dumps hasn’t been easier, in order to start out with an immediate raise to the gambling establishment account. Take a look at our very own needed listing and pick a 5 buck deposit local casino that fits all of your needs.

Up-to-time advice affecting your income tax get back

Aliens are known as nonresident aliens and you will resident aliens. So it publication will help you influence their position and provide you with guidance you will need to file your own You.S. taxation go back. Resident aliens are often taxed on the around the world earnings, exactly like You.S. owners. Nonresident aliens try taxed simply to their earnings out of offer in this the us and on particular income linked to the brand new run of a swap otherwise team in the usa.

Multiply the amount your registered from https://zerodepositcasino.co.uk/get-lucky-casino/ the pre-published dollar matter and you can go into the impact. Simply nonresident aliens that You.S. nationals; owners of Canada, Mexico, otherwise Southern Korea; otherwise pupils and business apprentices away from India who be eligible for pros lower than Blog post 21(2) of one’s taxation treaty that have India is also allege the little one income tax borrowing from the bank. One (or deceased person) that is (otherwise try) a great nonresident noncitizen of your own All of us to own house and you can present tax intentions may still features You.S. home and you may current taxation filing and you will payment personal debt. The newest devotion away from whether or not an individual is a good nonresident noncitizen to have U.S. home and current income tax aim differs from the fresh devotion away from whether or not one is a great nonresident alien to have U.S. government taxation motives. Home and you will present income tax considerations is actually outside the range out of that it guide, but data is on Internal revenue service.gov to choose whether one U.S. estate or present income tax considerations can get apply to your role. Aliens are known as resident aliens and you will nonresident aliens.

Account disclosures

Do not count the days on which you commute to work in the usa out of your house inside the Canada or Mexico for many who regularly drive away from Canada otherwise Mexico. You’re thought to drive frequently for individuals who travel to be effective in the united states for the more 75% (0.75) of the workdays using your doing work several months. Criteria to possess taxpayers who expatriated just before June 17, 2008, are no expanded chatted about from the Tips to possess Mode 8854 otherwise Pub. To have information regarding expatriation prior to June 17, 2008, see the 2018 Recommendations to have Mode 8854, and you may part 4 of one’s 2018 Club. For those who initiate the newest devotion, your citizen status is considered to be given up after you document both of your own after the data files with your Long lasting Citizen Card (environmentally friendly cards or Mode I-551) attached to the fresh USCIS or a great U.S. consular officer. Go to Internal revenue service.gov/Models so you can obtain current and past-season models, recommendations, and books.

Along with utilizing the same legislation as the You.S. owners to decide who is a centered, under the tax pact having Southern Korea, the kid must have stayed to your nonresident alien regarding the United states at some time inside tax 12 months. A good nonresident alien essentially never file because the hitched processing together. Although not, a nonresident alien who’s partnered so you can a great U.S. citizen otherwise resident can pick as treated because the a citizen and you will file a mutual come back to your Mode 1040 otherwise 1040-SR. If you don’t make the decision to file as you, document Setting 1040-NR and rehearse the fresh Tax Desk line or perhaps the Taxation Computation Worksheet for hitched anyone processing separately.

RentCafe Life style Room Pamphlet

Uncover what the right assets administration products does to alter your company. When you have questions relating to the city’s temporary rent and you may energy assistance programs, get in touch with the city’s COVID Program Professional, Laura O’Brien, from the Not all qualified houses qualify for the newest move-inside advice, eviction reduction, and restricted month-to-month subsidy. Houses which might be already acquiring subsidized guidance are not eligible for the brand new restricted monthly subsidy but could qualify for circulate-inside advice. When you yourself have gotten RMAP advice previously, you are ineligible. In order to assess monthly subsidy numbers, the family’s gross income and you can month-to-month lease are utilized.

Send and receive money people-to-person in the brand new U.S.

The total your retirement and you will annuity income different said because of the decedent and also the decedent’s beneficiaries usually do not surpass $20,one hundred thousand. For many who submitted a combined federal return and one companion are a north carolina Condition citizen plus the almost every other is actually an excellent nonresident or part-season resident, you have to document separate New york State production. The fresh nonresident otherwise region-season citizen, if necessary so you can file a north carolina County get back, need to explore Form It-203. However, for individuals who both love to document a mutual New york Condition return, explore Form They-201; one another partners’ earnings might possibly be taxed because the complete-12 months residents of brand new York County. A great taxpayer must statement all the nonexempt income gotten or accrued through the the brand new calendar year (away from Jan. step one due to Dec. 31) taxation several months. The newest Pennsylvania Company of Cash comes after the inner Money Services (IRS) due date to possess submitting productivity.

Citizen aliens which previously were genuine owners away from Western Samoa otherwise Puerto Rico are taxed according to the laws to own citizen aliens. Although not, you may also make the decision because of the submitting a joint revised return to the Function 1040-X. Attach Mode 1040 otherwise 1040-SR and you may go into “Amended” over the top of the remedied return.

To find so it exclusion, you otherwise the broker have to supply the following comments and you can information to your Commissioner or Commissioner’s subcontract. You’re going to have to pay the punishment for many who filed it form of return otherwise entry considering an excellent frivolous condition or a need to slow down or affect the brand new government of federal tax laws and regulations. Including changing otherwise striking out the newest preprinted words above the room sent to the trademark.

Our very own overdraft commission to have User examining membership are $35 for each goods (perhaps the overdraft is through consider, Automatic teller machine detachment, debit card transaction, or any other digital setting), so we charge only about three overdraft fees for each company go out. Overdraft charges are not appropriate to pay off Availableness Banking accounts. Please note that the get offered less than this particular service is for instructional motives and may never be the fresh get utilized by Wells Fargo to make borrowing from the bank conclusion. Wells Fargo talks about of many things to determine your own borrowing from the bank alternatives; for this reason, a certain FICO Score or Wells Fargo credit rating will not make sure a certain loan speed, approval out of financing, or an update to the a charge card.

- Although not, the entire process of gathering dumps and you will handling dedicated membership can make a demanding work, compelling of several landlords to take on protection deposit options you to lose administrative weight.

- Inability to prompt declaration and pay the have fun with tax owed get result in the research of great interest, punishment, and you will charges.

- You additionally may want to like a cards union if you have trouble with antique banking features otherwise criteria.

- For many who don’t have the complete security put count or if you wear’t want your finances stuck regarding the put on the identity of one’s rent, you’ve got several options.

- Required Electronic Costs – You need to remit all of your payments electronically after you build an estimate or extension fee exceeding $20,100000 or you file exclusive come back with a complete income tax accountability more $80,one hundred thousand.

State-by-condition distinctions from security put attention law

You can even getting susceptible to a penalty from $fifty if you do not give the SSN or ITIN to help you another person if it is expected to your a profit, a statement, or any other file. If there’s any underpayment out of income tax on your own get back due to help you fraud, a punishment of 75% of the underpayment due to fraud might possibly be added to the tax. You would not have to pay the newest punishment if you can show that you’d a very good reason to have not paying your tax punctually. Civil and you will violent charges are offered to own neglecting to document a great report, submitting a research that has issue omissions otherwise misstatements, otherwise submitting a bogus otherwise deceptive report.

For more information, see Functions Performed for International Boss within the section step three. Thus the international earnings are at the mercy of You.S. income tax and ought to getting advertised on the You.S. income tax come back. Income from resident aliens is susceptible to the new finished taxation prices you to apply to U.S. citizens. Citizen aliens make use of the Tax Table otherwise Taxation Computation Worksheets found from the Tips to have Mode 1040, which connect with U.S. owners.

Wages paid so you can aliens that citizens of American Samoa, Canada, Mexico, Puerto Rico, or the You.S. If you are eligible for the key benefits of Blog post 21(2) of the All of us-Asia Tax Treaty, you may also claim an additional withholding allowance to the fundamental deduction. See Withholding to the Scholarships and grants and you will Fellowship Has, afterwards, based on how so you can fill in Function W-cuatro for those who discover an excellent You.S. origin scholarship or fellowship offer that is not a fee for services.