Mode 8233 can be utilized if you are saying an exception to own grant otherwise fellowship income (that isn’t compensation) only when you are and claiming an excellent pact withholding exception to have individual services income. Even if you submit Form 8233, the new withholding agent might have to withhold taxation from the money. It is because elements on which the newest treaty exception is actually based might not be determinable up to pursuing the close of the tax season.

With regards to fees withheld from the origin, the new treaty stops to possess effect on January step 1, 2024. According away from almost every other taxation, the brand new pact 5 Lions Gold big win stops for feeling regarding income tax attacks birth to your or just after January step one, 2024. For the June 17, 2024, the united states provided authoritative find to the Russian Federation away from the newest partial suspension of the treaty which have Russia. The united states provides suspended the new process from part 4 of Article step 1, Posts 5 as a result of 21, and you will Blog post 23 of one’s Conference, plus the Method. Nonresident aliens is also allege some of the same itemized write-offs you to definitely citizen aliens can also be allege. But not, nonresident aliens can be claim itemized deductions on condition that he’s got money effortlessly linked to its You.S. change or business.

Line 22 – Exclusion borrowing from the bank: 5 Lions Gold big win

Our remark party makes sure the main benefit rules is reasonable to players. We test all incentive to ensure the words are unmistakeable and you will adopted to the letter. You just register, create a deposit having fun with WLCMPS200 code and claim their bonus. The degree of focus gained to your a great Computer game may vary centered on their deposit, Cd price and you may name length. For example, an excellent $ten,100000 deposit inside a good five-seasons Computer game which have 3.50% APY do secure as much as $step one,877 inside interest.

Should i legally explore my personal security deposit while the last month’s book?

In this case as well, there isn’t any specifications showing financial solvency. In case your candidate is actually a citizen away from a good MERCOSUR nation, there are many limited changes. Firstly, you can utilize your own federal label cards as opposed to a great passport.

Team

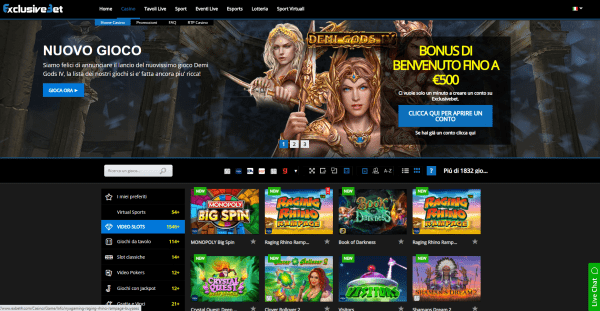

Gambling enterprises typically have a-flat listing of constraints about how far professionals can also be withdraw in the a given period of time. However, limits usually range between local casino to gambling establishment because they’re the ones who typically decide what sort of restrictions needed to implement. Some provides detachment limits out of $eight hundred a day, while some could possibly get set a withdrawal limitation away from $eight hundred one hour.

The cash can be used to resolve otherwise exchange belongings in their local rental unit after you escape. A state rules determines simply how much will likely be energized, the way it can be used, as well as how they’s as reimbursed. 4Some claims require an attraction-affect escrow make up protection deposits however some wear’t want focus. Affiliate try in charge to check on state laws and regulations in addition to laws and regulations to have get together and reimbursing a refundable shelter put. A brief overview from security deposit legislation to possess escrow accounts inside all fifty claims can be found here. For each and every state have somewhat additional legislation to possess shelter dumps.

- If happy with all the details, the newest Internal revenue service will determine the degree of your tentative tax to your income tax 12 months on the revenues efficiently related to the change otherwise business in the us.

- When you have checks to deposit, preparing them from the finalizing the back.

- When you yourself have a current account, you must add a supplementary $10,100 to the current equilibrium during the time of enrollment.

- Get into “Exempt earnings,” the name of one’s treaty country, and the pact blog post giving the fresh exemption.

A percentage from U.S. resource earnings otherwise losses from a collaboration that’s involved with a swap otherwise organization in the us is even efficiently associated with a trade otherwise business in the us. Within the limited points, certain kinds of foreign source money could be managed while the efficiently linked to a trade or organization in the usa. The difference between these two groups is that effectively connected money, after deductible deductions, is taxed in the finished cost. They are exact same cost you to affect You.S. citizens and owners. Income that isn’t effortlessly linked try taxed in the a flat 30% (otherwise all the way down pact) rate.

Please be aware one driver information and you will video game information try upgraded continuously, but can vary through the years. Yes, you possibly can make in initial deposit even if you’re having fun with a smartphone or pill, providing you have access to the brand new local casino of your choosing via a mobile device. Thankfully that most online casinos now allow it to be playing on the go.